Wise vs PayPal in Malaysia - Which is better?

Wondering how PayPal vs Wise compares in Malaysia? We compared the exchange rates, fees and features in our in-depth review of the two providers.

PayPal is a quick, safe and convenient way to shop online and send or receive payments. You won’t need to enter your card details every time you visit an ecommerce store, and transferring money to family and friends is simple.

If you use PayPal for local online shopping and making personal domestic payments, you may not pay extra fees for the services PayPal provides. However, if you use your Malaysian PayPal account internationally, or if you’re a business customer, PayPal charges fees you need to know about.

This guide will walk through all of PayPal’s service charges, and offer a smart way of cutting PayPal’s currency conversion and international payment charges, by using Wise. Let’s dive right in.

| Table of contents |

|---|

We’ll get into the details about PayPal’s fees for sending money in just a moment. But first, let’s look at one PayPal service charge which makes all the difference when sending money abroad - the PayPal currency conversion fee.

Whenever you convert currencies with PayPal - either in your own account balance, or when you send a payment overseas - there’s a PayPal currency conversion charge to pay, which can be as much as 4% of the transaction value. This pushes up the overall costs, and can mean your recipient gets less than you expect.

Take a look at Wise as a comparison. Wise offers international payments which use the mid-market exchange rate - the one you’ll find on Google - with no markup. There’s a straightforward and transparent transfer fee to pay - which can be better for you, and the person you’re sending money to.

If you use PayPal Malaysia for personal use, you won’t pay a fee for most transactions made using MYR. However, you need to be careful if your transaction needs a currency conversion, as PayPal’s exchange rate might be a costly surprise.

Here’s a summary of the personal fees levied by PayPal. We’ll look at each situation below thoroughly¹.

Sending a payment in MYR is free for the sender if you’re paying with a bank account or PayPal balance- but the recipient might have to pay a fee. If you fund your payment with a card, there’s a 3.4% fee to pay¹.

Example:

- Sending 5,000 MYR to a friend in Malaysia, who will receive in MYR

= Free

Neither you nor your friend need to pay a fee.

The PayPal service charge to send international payments is 4.99 USD. You’ll pay this when you send money funded from your bank account or PayPal balance. If you want to pay with a card there’s an additional 3.4% PayPal transaction fee¹.

If the payment is made in a different currency, there’s a conversion cost to cover. Here’s what PayPal says about the costs of sending payments²:

“You don’t need to pay a transaction fee when you send payments with PayPal. The recipient covers that. If you send a payment overseas in a different currency, a small conversion fee applies.”

Examples:

- Converting 5,000 MYR to USD and sending it to a friend in the USA

= 4.99 USD PayPal transaction fee + 3.5% markup on the exchange rate used.

This means in addition to the 4.99 USD charge, you’re actually paying 3.5% of 5,000MYR (175MYR) as a currency conversion fee. Your recipient receives the equivalent of about 4,825MYR in USD.- If you choose to fund your transfer by card, PayPal charges a fee of 3.4% on top of the other fees you’ll pay

If any transaction requires currency conversion - when you’re sending money overseas, or shopping online at a retailer based abroad for example - PayPal will set the exchange rate used.

PayPal’s exchange rate is called the transaction exchange rate. Here’s what PayPal says about how the transaction exchange rate is calculated³:

“The transaction exchange rate is adjusted regularly and includes a currency conversion fee applied and retained by us on a base exchange rate to form the rate applicable to your conversion.”

What this means is that PayPal takes the base exchange rate, and adds a markup - known as a currency conversion fee - to create the exchange rate that they offer customers.

If you have a PayPal Malaysia account, the currency conversion fee PayPal adds will be 3.5% - 4% when sending money. When you receive foreign currencies, or convert currencies within your balance, 2.5% is added to the base exchange rate.

Here’s the full currency conversion fee listing for reference¹:

| When you convert MYR into [currency] | Fee: |

|---|---|

| Australian dollar | 4% |

| Brazilian real | 4% |

| Canadian dollar | 3.5% |

| Czech koruna | 4% |

| Danish kroner | 4% |

| Euro | 4% |

| Hong Kong dollar | 4% |

| Hungarian forint | 4% |

| Israeli new shekel | 4% |

| Japanese yen | 4% |

| Mexican peso | 4% |

| New Zealand dollar | 4% |

| Norwegian krone | 4% |

| Philippine peso | 4% |

| Polish zloty | 4% |

| Russian ruble | 4% |

| Singapore dollar | 4% |

| Swedish krona | 4% |

| Swiss franc | 4% |

| Taiwan dollar | 4% |

| Thai baht | 4% |

| UK pounds | 4% |

| US dollar | 3.5% |

| When you convert currencies within your PayPal balance; when you withdraw different currencies into your MYR bank account; when your sender sends in different currencies but you want to receive in MYR | Fee: |

|---|---|

| All currencies | 2.5% |

Shopping online with sellers based in Malaysia will not normally incur a fee from PayPal. However, shopping with merchants based abroad, or when using a card might mean you have to pay a charge.

Receiving a payment in MYR from friends or family should not cost you anything.

If you receive a payment in a currency other than the one your PayPal account is configured to hold, you may pay a currency conversion fee before you receive the money³:

“Certain currencies can only be received by converting the balance into another currency that PayPal allows you to hold. If the balance is converted, PayPal's transaction exchange rate (including our currency conversion fee) will be used.”

Examples:

- You have a PayPal balance in MYR and receive 5,000 MYR from a friend in Malaysia

= Free

Neither you nor your friend need to pay a fee.- You have a PayPal balance in MYR, but your friend in the USA sends 1,000 USD

= 2.5% markup added to the exchange rate.When you convert 1,000 USD to MYR, PayPal’s currency conversion fee (2.5%) will be deducted from the amount you receive.

Withdrawing your balance is free if 400MYR or more is withdrawn, but you’ll pay 3 MYR if you want to withdraw less than 400 MYR¹.

It’s worth noting, though, that if you have other currencies in your PayPal balance, and want to withdraw it to your bank account in MYR, PayPal’s currency conversion fee will be applied.

Examples:

- You have a PayPal balance in MYR and want to withdraw 1,000 MYR to a bank account

= Free- You have a PayPal balance in USD and want to withdraw 1,000 USD to a Malaysian bank account

= 2.5% (25USD) conversion fee will be deducted

You can hold different currencies in your PayPal balance, but you need to know that there’s a 2.5% currency conversion fee when you switch currencies¹.

Example:

- You have 1,000 USD and want to convert to MYR in your account.

25 USD(2.5%) will be deducted, so you’ll get MYR which is equivalent to 975USD.

Take a look at the low cost international transfers available from Wise, to see if you can save.

Wise uses low, transparent fees without any mark-up on exchange rates. You can send money overseas from Malaysia to 70+ countries with the mid-market exchange rate.

If abroad, you can also receive money to your own multi-currency account from the UK, US, Australia, New Zealand, any Eurozone country, and a selection of other major countries, as if you had a local account there.

Hold dozens of different balances all in the same place, and switch between them using the mid-market exchange rate whenever you need to. You’ll only ever pay a low, transparent fee. You can get a linked Wise card, too.

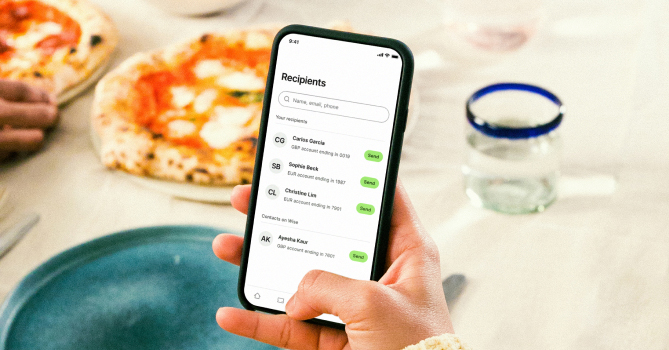

To send money with Wise:

And that is it! You can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Start saving money with Wise 🚀

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

PayPal can also be used for businesses. In this case, you might find you face different fees compared to the personal account costs described above. Here’s a summary - we’ll dive into these fees in more detail in a moment⁴;

The PayPal transaction fee for receiving payments is 3.9% + 2 MYR (from Malaysia), or 4.4% + fixed fee (from elsewhere)⁴.

It’s worth noting that the fixed fee for international payments varies according to the country you’re selling in - and there may also be an additional currency conversion charge to pay when you sell overseas. This will also apply if you take payments in a foreign currency, but then convert to MYR to withdraw to your regular bank account - more on this later.

Like personal accounts, it’s free to send payments, but PayPal’s currency conversion fee will apply if you need to convert from MYR to USD for example.

We mentioned above that you may pay a fee to withdraw foreign currencies to your normal MYR bank account. That’s because of PayPal’s currency conversion fee.

In effect this means that to withdraw a currency, you need to pay the conversion fee to switch the amount within your PayPal account - 2.5% - before you can send the payment to your MYR bank account. So if you have 1,000 USD, you’ll end up with MYR which is equivalent to 975 USD in your bank account.

As with your personal PayPal account, a currency conversion fee of 2.5% will be deducted if you want to convert one currency to another within your PayPal balance⁴.

PayPal is globally popular for good reason. It’s easy and convenient to shop online and make payments with PayPal - however, there are fees you need to know about, especially if you use PayPal for international transactions.

Take a look at the exchange rates and fees over at Wise, if you’re looking for a simple online way to send money to friends and family overseas, or to settle an international business invoice. You might find you can save.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering how PayPal vs Wise compares in Malaysia? We compared the exchange rates, fees and features in our in-depth review of the two providers.

Sunway Money offers international transfers from Malaysia to 60+ countries, with funds being deposited directly into bank accounts around the world in a range...

Looking to make an international transfer with BigPay? We reviewed the fees and limits, and compared the cost with an alternative provider Wise.

Here's how to transfer money from PayPal to your Malaysian bank account from your PayPal account

Not sure whether to use InstaRem vs Wise to send money abroad? We compared which could be better for international transfers in Malaysia.

Wondering what are the charges for Instant Transfers (IBFT)? Malaysian banks usually don't have any fees but we covered a few exceptions.