Can a foreigner open a bank account in Malaysia? Guide for foreigners

Foreigner opening a bank account in Malaysia? Read more what options are available, documents needed to open a bank account and more

If you love to travel, shop with international ecommerce stores, or have to pay bills overseas, a foreign currency or multi-currency account might help you save on international transaction fees. The HSBC Everyday Global Account¹ from banking giant HSBC is one popular option, with 11 currencies and a linked international debit card.

This HSBC Everyday Global Account review covers all you need to know if you’re thinking about opening an account for your international transactions, including how to use the HSBC Everyday Global Account, and the fees and exchange rates you should be aware of. We’ll also compare the HSBC Everyday Global Account Malaysia to the Wise multi currency account as a bonus, to help you decide which product suits you best.

Multi-currency accounts allow customers to hold, exchange and spend a range of different currencies conveniently. They’re a great tool for anyone living an international lifestyle because they can help you cut the costs of receiving, converting, sending and spending foreign currencies - and often save time and hassle, too.

HSBC’s Everyday Global Account lets users hold up to 11 currencies in the same account, with access to a range of services including a debit card, rewards for spending, currency conversion with competitive rates and more. Here’s what you need to know.

You can use your HSBC Everyday Global Account for day to day spending, including being able to hold and convert between up to 11 currencies within the account. There are discounts on offer whenever you spend using your linked international debit card, and no monthly fee or minimum balance to maintain. Depending on your account balance, you might also earn interest on the funds you hold.

The Everyday Global Account allows users to hold MYR and 10 foreign currencies²:

With your account you’ll get 24/7 access to mobile and online banking services from HSBC, which means you can exchange any currency in your account in just a few clicks. The HSBC or Visa foreign exchange rate will apply whenever you switch between currencies, or if you need to send or spend in a currency not supported by your account. This is likely to include a markup - an extra fee - on the mid-market exchange rate. We’ll take a look at an alternative option, the Wise multi currency account, which doesn’t use an exchange rate markup, a little later.

HSBC’s Everyday Global multi currency debit card can be used for shopping with international ecommerce stores, and to spend and withdraw cash when travelling. The account base currency is MYR, but if you hold any eligible foreign currency in your account you’ll be able to send payments, make withdrawals or spend, without foreign transaction fees.

The HSBC Everyday Global Account does come with some handy multi-currency features - but it’s important to note that there are still international transaction fees to pay. These include service fees when you send or receive an international payment in a supported currency, and a foreign transaction fee when you spend a currency that’s not supported in your account. It’s also useful to know that when you exchange between supported currencies in the account you’ll get the prevailing HSBC or Visa exchange rate which may include a markup.

An exchange rate markup is commonly used by banks and currency exchange services - but it’s an extra fee which can push up the overall costs of currency exchange. If you’d rather avoid currency exchange markups, and see all the costs of your international transactions more transparently, you might prefer the Wise multi currency account. More on that coming up later.

The HSBC Everyday Global Account is available to HSBC regular, Premier and Advance customers. However, the terms and conditions - as well as the fees which apply - do vary between these account categories.

We’ll take a look at the account eligibility requirements a little later so you can choose which might suit you best. For now, here are the fees you need to know about³:

| Service | HSBC Everyday Global Account fee |

|---|---|

| Account opening fee | No fee |

| Account dormant fee | No fee to reactivate a dormant account - however, a fee of 10 MYR/year will be charged until a dormant account is closed |

| Cash withdrawal at an HSBC Malaysia ATM | No fee |

| Cash withdrawal at a Visa PLUS network ATM | 10 MYR If you withdraw in a currency you don’t hold in the account, there is also a 1% charge + any applicable Visa fee |

| Cash withdrawal at MEPS shared ATM network | Regular account holders - 1 MYR/ withdrawal Advance customers get 2 free withdrawals/month, Premier customers get 3 free withdrawals/month |

| Cash withdrawal at an HSBC overseas ATM | 5 MYR, waived for Premier customers |

| Foreign transaction fee | Spending in a currency you don’t hold in the account comes with a 1% charge + any applicable Visa fee |

| Sending an international payment | Sending a payment in a currency you hold in the account: Fee based on the currency being sent - 6 SGD or 4 USD for example + cable charges Regular telegraphic transfers: 25 - 51 MYR depending on the details of the payment |

| Receiving an international payment | 5 MYR for currencies not supported in your account When receiving a payment in a supported currency, you’ll pay a fee based on the currency being sent - 6 SGD or 4 USD for example |

If you want to open an HSBC Everyday Global Account you’ll first need to choose between the regular, Advance, and Premier account - each account tier has its own eligibility requirements, and comes with its own features and fees. How you open your account will also depend on whether you’re an existing HSBC customer, and whether you’re a foreigner in Malaysia or a Malaysian citizen. Here are the details.

The account you’re eligible for will depend on your minimum account balance or your existing relationship with HSBC:

If you’re an existing HSBC customer looking to open an additional HSBC multi-currency account you’ll be able to leave your details on the HSBC website and have a member of the service team get in touch to talk you through the process. Alternatively, you can make an appointment to visit a branch in person to get your account up and running.

If you’re new to HSBC, aged over 18, and a Malaysian citizen with a valid MyKad you might be able to start to open your account online - but you’ll still need to visit a branch within 30 days of opening to verify your account and get it fully up and running. Here’s the process:

If you’re a foreigner in Malaysia, or if you don’t want to use MyKad for any reason, you’ll need to visit a branch in person to open your account. You can set up an appointment online to make the process a little smoother.

If you’d rather open your multi-currency account without visiting a bank branch - or if you’d like a more flexible way to hold and spend foreign currencies - you might be better off with the Wise multi currency account.

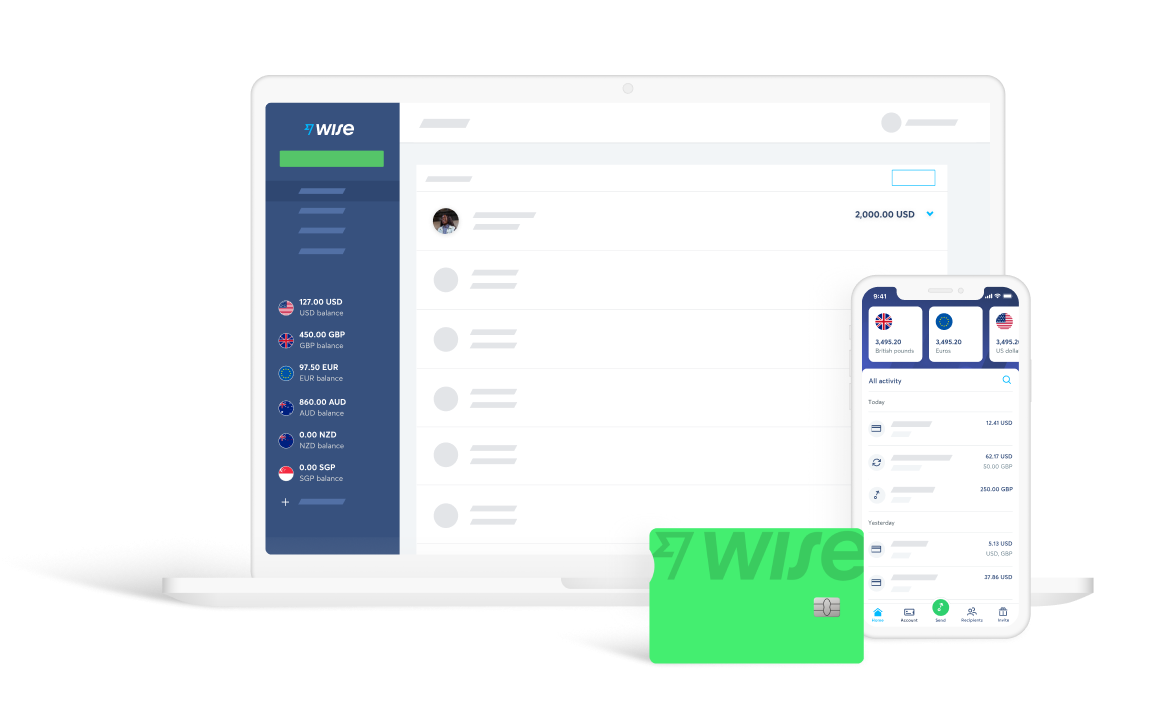

The Wise account is available to both Malaysian citizens and non-Malaysians, with no monthly charge or minimum balance requirements and can be opened online from anywhere. You’ll be able to hold and exchange 50+ currencies, get paid fee free from over 30 countries, and spend using your linked Wise debit card all over the world. Best of all, all currency conversion uses the mid-market exchange rate with no markup, and no hidden fees.

The Wise account is a great low cost way to transact internationally. It offers many of the features bank accounts do, and often has lower fees. The right account pick for you, though, depends on exactly what you’re looking for. Here’s a quick look at some of the key features of both accounts:

| HSBC Everyday Global | Wise Multi-currency Account | |

|---|---|---|

| Minimum balance | No minimum for regular accounts, minimum balance requirements for Advance and Premier account types | No minimum balance |

| Available currencies | 11 currencies | 54 currencies |

| Debit card | Yes | Yes |

| Interest rate | Interest is paid - rates depend on the balance of the account | No interest |

| Send payments overseas | Sending a payment in a currency you hold in the account: Fee based on the currency being sent - 6 SGD or 4 USD for example + cable charges Regular telegraphic transfers: 25 - 51 MYR depending on the details of the payment. Exchange rate markups may also apply | Low fees and the mid-market exchange rate |

| Receive international payments | 5 MYR for currencies not supported in your account When receiving a payment in a supported currency, you’ll pay a fee based on the currency being sent - 6 SGD or 4 USD for example | Free - you’ll also get your own bank details to get paid like a local from 30+ countries |

If what you want is a multi-currency account from a traditional bank, the HSBC Everyday Global Account might be a solid bet. HSBC is a world-renowned brand, with great international presence and a strong branch network, and the account comes with handy features like the linked debit card and 11 eligible currencies. However, if you’re looking for a lower cost account with a more flexible range of currencies, the Wise multi currency account could suit you better.

With Wise you can hold 50+ currencies, send payments to 80+ countries, spend all over the world with your linked international debit card, and get paid like a local from 30+ countries. You’ll always get the real mid-market exchange rate with low, transparent fees whenever you transact or switch between currencies, so there are no surprises - just easy, everyday borderless money management.

Sources:

Sources checked on 20.05.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Foreigner opening a bank account in Malaysia? Read more what options are available, documents needed to open a bank account and more

Looking to open a bank account online Malaysia? Read more about how to open a bank account or international account online and their requirements.

Looking to open a CIMB current account in Malaysia? Here's how to open an account with CIMB and review of each current account.

Need a local bank account in Singapore? Here’s how to open an account online in Malaysia, without leaving your home.

Revolut isn’t currently available for Malaysians. We cover the best non-bank providers similar to Revolut.

Find out the best foreign currency accounts in Malaysia in 2022. Know what to consider when choosing the right account for all your international transfer needs