Can I use Monzo in India?

Check out our handy guide to using your Monzo card and account in India, including what fees you can expect.

Heading to India from the UK for a holiday, work or to see friends and family? It’s a good idea to plan how you’ll manage your spending while you’re there.

If you’re a Revolut customer here in the UK, it’s useful to know whether or not you can use your Revolut card to spend in Indian rupees (INR) during your time abroad.

Read on, as we’ve put together a handy guide covering everything you need to know.

This includes a quick look at a great alternative for overseas spending from the money services provider Wise - the Wise card. This international card automatically converts your money to INR at the mid-market exchange rate whenever you spend, only adding a small, upfront currency conversion fee.

But for now, let’s focus on using your Revolut card in India.

The good news is that yes, you can use your Revolut card when you travel to India.

You can use it for purchases in shops and restaurants, online purchases and ATM withdrawals wherever Visa and Mastercard are accepted.¹

You can spend in INR using your Revolut card and you can hold the currency in your Revolut account.² This means you can convert currency and top up your balance in the local currency in the Revolut app ahead of your trip.

Also, the Revolut card converts your pounds to rupees dynamically at the moment of purchase if you don’t hold INR in your account. This means that whenever you spend, the currency is automatically converted from GBP to what Revolut describes as a ‘settlement currency’. This is usually USD, and this is what will be paid to the merchant.²

There are a few fees related to using your Revolut card in other countries, depending on when and how much you spend. Here’s a quick look at their Standard plan fees (fees can differ for other tier plans):

| Transaction | Revolut fee (Standard plan)³ |

|---|---|

| Additional merchant surcharge fees (for paying by card) | Set by the merchant (if applicable) |

| Currency exchange transactions above £1,000 | 1% |

| Currency exchanges on weekends | 1% |

There’s also the exchange rate to consider. Revolut uses their own Revolut exchange rate⁵ when you convert your GBP to INR which can be different from the mid-market exchange rate. But more crucially, this is only for converting currency during the week. If you do it on a weekend, an additional 1% charge will apply to whatever you spend or convert.

Also, if you choose to be charged in your home currency when using your Revolut card to shop abroad, the merchant will apply their own exchange rate.³ This usually has a mark-up added on top of the mid-market exchange rate, so it ends up costing you extra.

If you’ll be spending a longer period of time in India, you may be thinking of getting a Revolut account. Unfortunately, you’ll have to wait a little while. Revolut India is on the way, but at the moment you can only sign up to be on the waiting list.⁴

However, you can still use Revolut to send money from the UK to India.

You shouldn’t have to worry about spending on the weekends, not when you’re on holiday.

This is why alternatives providers like Wise offer the mid-market exchange rate all the time, with no extra charges for spending in INR at weekends.

Open a Wise multi-currency account online and you can get a Wise card which you can use to spend in the local currency in over 150 countries, including India.

Your money is automatically converted to Indian rupees at the mid-market exchange rate, so you don’t have to worry about pre-loading your account or converting cash. There’s only a small, upfront conversion fee to pay, or it's free if you already have INR in your Wise account.

Need cash? You can even withdraw up to £200 a month from Indian ATMs for free (although double-check that the ATM operator doesn’t charge its own fee).

Sources used:

Sources last checked on date: 12-Apr-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Check out our handy guide to using your Monzo card and account in India, including what fees you can expect.

A complete guide to buying antiques in India, including tips for UK buyers on the best antique markets in India.

A handy guide on how to buy an Indian sim card, including major mobile network operators and prices for prepaid plans.

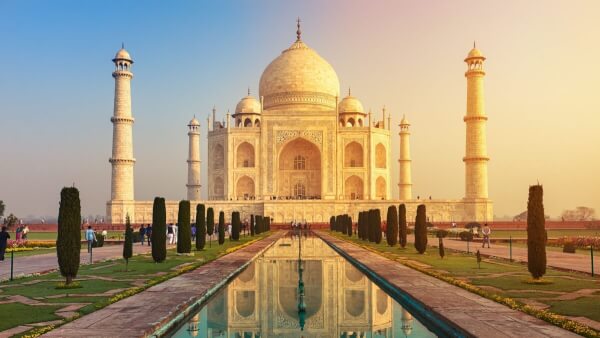

If you’ve never considered a trip to India, you should think again. From the food to the stunning religious monuments, India has plenty to see and experience....

Planning a visit to India? It’s a culturally diverse country with vibrant cities, breathtaking beaches, and majestic mosques. It’s a true destination for many...

If you’re travelling to India on holiday, you can’t get cash ahead of time. Indian law doesn’t allow foreigners to bring Indian currency into the country,...